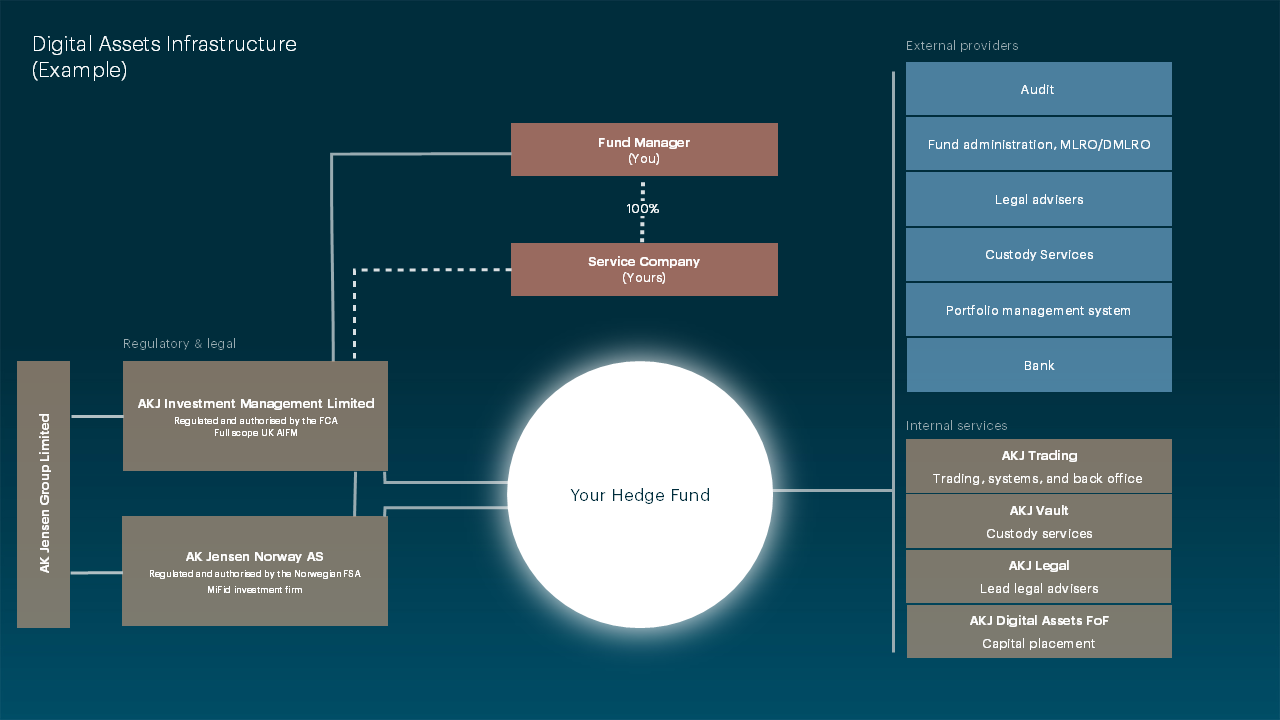

AKJc enables all components necessary for the set up and day-to-day operation of a regulated, tier-one hedge fund trading digital assets:

- A legal and regulatory solution with an infrastructure designed to appeal to institutional-grade investors

- Secure, multi-exchange trading and settlement allowing efficient management of digital assets

- An in-house capital allocation program - AKJ Digital Assets FoF - investing in qualifying funds on the platform

- A dedicated and installed team of hedge fund specialists as your support and backoffice staff

- Aggregated platform pricing from tier-one providers

- Discretionary participation in the ecosystem for additional platform utilities

Together, these components allow a front-to-back, tier-one solution for hedge fund managers trading in digital assets.

HFM Awards

AKJ has won the HFM Best Hedge Fund Platform award seven times out of the past eight years.